Strategic Nonprofit And Tax Law Services

For Lawyers And Their Clients.

We help lawyers embrace philanthropy and leverage the power of the tax code to:

Unlock a lifetime of grants and funding to teach the law and empower more people

Gain more goodwill, trust, credibility, authority, and recognition for their contribution

Expand their business, form new partnerships, and offer a range of innovative services

Test and develop educational courses, programs, workshops, podcasts, or memberships

Lower income tax, capital gains tax, inheritance tax, gift & estate tax, trust/estate tax, corporate tax, etc.

Protect their assets and investments from internal or external threats or risks

Leverage the power of private foundations to redirect otherwise taxable income into impact investments

Incorporate the same startegies being leveraged by family offices serving fortune 500 founders & billionaires

We've also cloned our "Nonprofit & Tax Law Firm" so law firm owners can bolt-on our services and:

Develop a virtual, lucrative, and flexible revenue stream that applies across all 50 states

Increase earning per case by offering a range of legal and tax entity structuring work

Attract successful entrepreneurs, investors, and business owners with sophisticated portfolios

Unlock a recession-proof revenue line that is not based on billable hours or litigation

Boost the earnings and profits per case by bolting-on additional services ($20,000 - $50,000/case on average)

Explore the wonderful, exciting, and stimulating world of strategic tax law where you can apply everything you learn and uncover in the course of your work

ABOUT US

I didn't choose "LAW" - it choose me.

Hello Attorneys,

Sid Peddinti™ here - I'm thrilled you're here - regardless of how you stumbled upon my page.

My story is simple:

In 2005 - the banks crushed my business and forced me into the ground. They picked apart my entities with ease, and forced me into a million dollar bankruptcy at the age of 22. That experience put on the quest that I'm still on today - to learn, teach, and leverage the power of the law across all fronts.

I've completed several business and tax certifications in Canada, completed Law school in the UK, then a LLM in the US, and have worked with over 10,000 businesses in diverse capacities - protecting and restructuring over $5 billion in assets and IP.

I got this into area of law because it impacted me and - to me, this is not just another "area of law that seems fun and lucrative" (which it is), this body of law contains the keys to how we can protect, preserve, and pass-on our wealth to the next generation with confidence. It impacts us, our loved ones, and our heirs down the line.

My mission today has evolved into educating and protecting consumers and business owners from scammers, from big banks, from creditors, and from fake legal practitioners who are offering legal work with no qualifications, no training, no experience, and no ethics or morals in place.

I invite you to explore the resources we've put together here, connect with me, and explore how we can incorporate these strategies to boost your firm, amplify your impact, and protect your wealth by installing some of these strategies in your own law firm and personal investments, where applicable.

Talk soon,

Sid Peddinti™

BA, BIA, LLB/JD, LLM

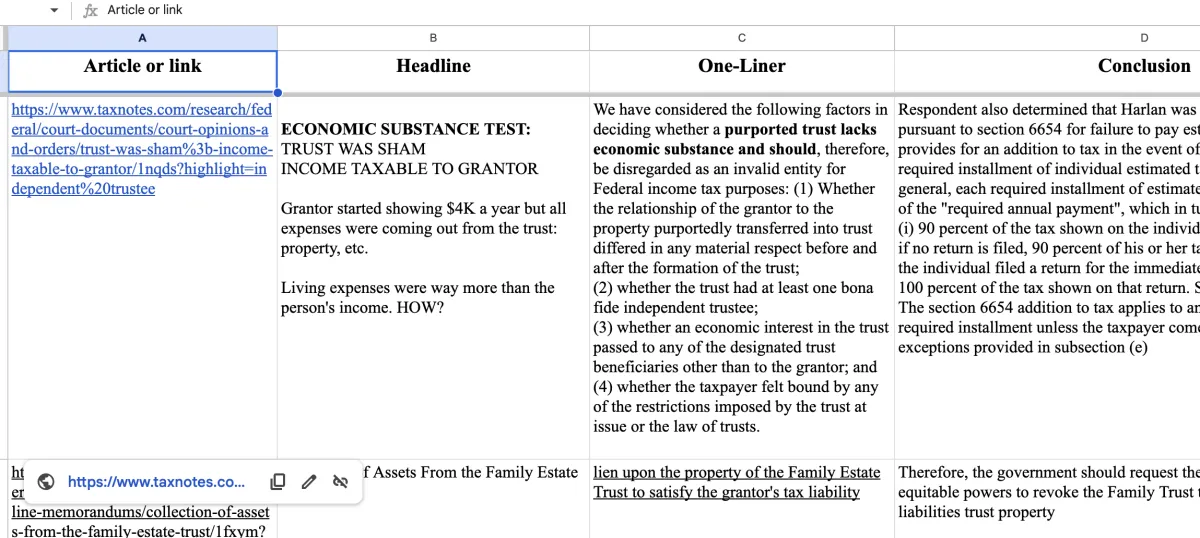

Discoveries Through Intense Tax Research

After 20 years of research and testing, we have discovered a lot of incredible things that are hidden in numbers and startegies - tax records tell a story, one that can change the way you earn, save, and pass on wealth.

From unlocking millions in grants to teach the law, to reducing 30-60% of your taxes every year for the rest of your life, beating inheritance, probate, estate, and gift taxes, and even expanding your business through the art of donating and gifting time, talent, and treasure strategically - it was all in the tax code.

These are strategies that MOST lawyers have not used themselves, nor are they offering these strategies to their clients - and that's the "GAP" that scammers, spammers, and sham trust drafter have captured and monetized without any sort of liability.

Well - it's time to put together a team of attorneys who are willing to fight for our client's rights against these scammers and fraudsters. Explore the benefits of learning, leveraging. and also offering nonprofit and tax law services to your marketplace, to your clients, and to your family and friends as well.

We need you, the consumers need you, and even the government needs US to step up and fill the gap by educating and empowering people with the knowledge, tools, and research needed to make smart and educated decisions.

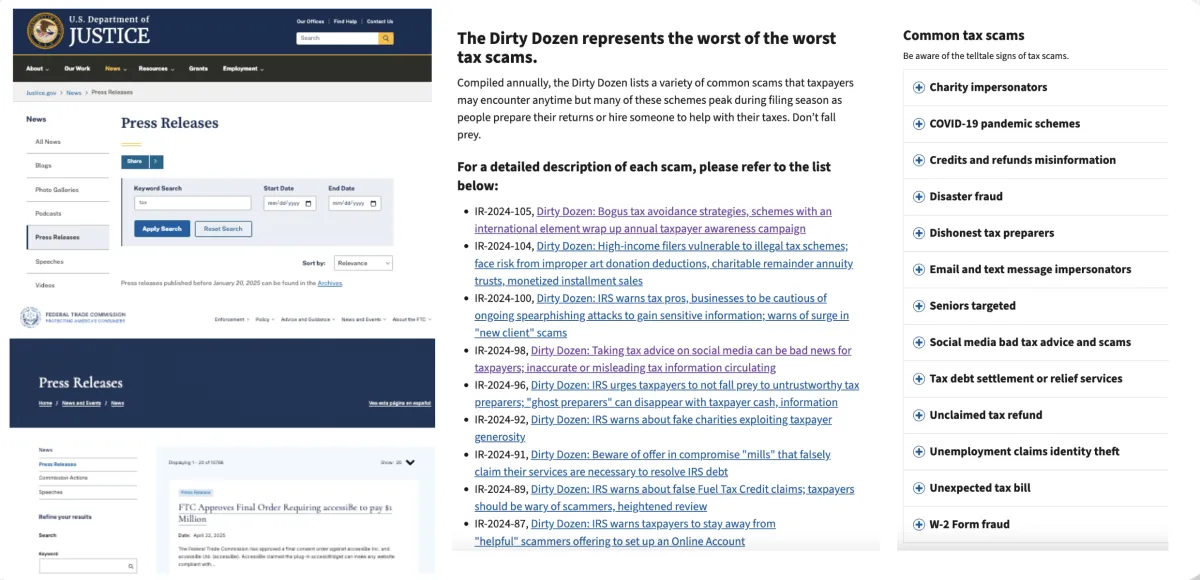

Scams across multiple industries

Research across multiple BENT Law areas

I've presented on these topics hundreds of times

Here is why this work matters - protecting consumers

Every single client needs tax strategic help, and you are in the most ideal position to provide that service.

Are you a law firm owner who has built a successful practice, serving hundreds or even thousands of individuals and families - clients you’ve gained through reputation, targeted marketing, and strong referral relationships?

If so, you’re perfectly positioned to integrate a tax consulting and advisory practice into your firm, unlocking exceptional client value and boosting your revenue potential.

Imagine adding another $3,000 - $50,000 or more in revenue per client, and in some cases, even upwards of six-figures in tax advisory and consulting services - services that NON-ATTORNEYS are currently occupying and even dominating in certain niched markets - these are the clients WE (lawyers) should be serving - and the incorporation of tax strategies allows you to pierce that specific gap.

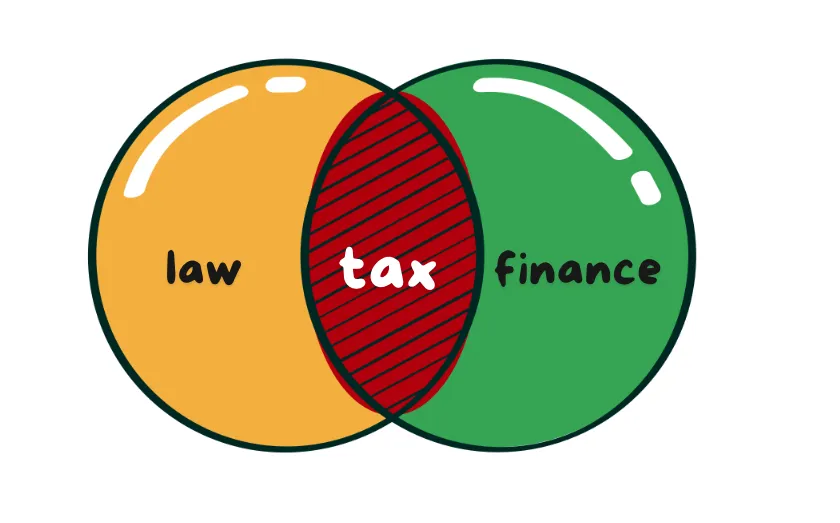

By “bolting on” a tax law arm to your firm, you’ll fill a significant industry gap that only an attorney is truly equipped to bridge. Here’s why:

Accountants typically focus on bookkeeping, tax preparation, and filing - not tax planning and strategy. They leave that function to the lawyers.

Meanwhile - Estate lawyers are leaving "tax planning and strategy" to the accountant and financial advisors.

Financial Advisors and Insurance Agents rarely offer any type of entity structuring or tax strategy.

The result?

No one is creating a “holistic tax and legal strategy” for clients - and that's the spot where scammers have step in and taken over.

This leaves clients without a coordinated plan, with gaps in their tax and legal structures, and advisors working in silos.

Integrating tax law into your firm changes this, allowing you to connect the dots, protect your clients from oversight, and ensure all advisors work toward a common strategic goal.

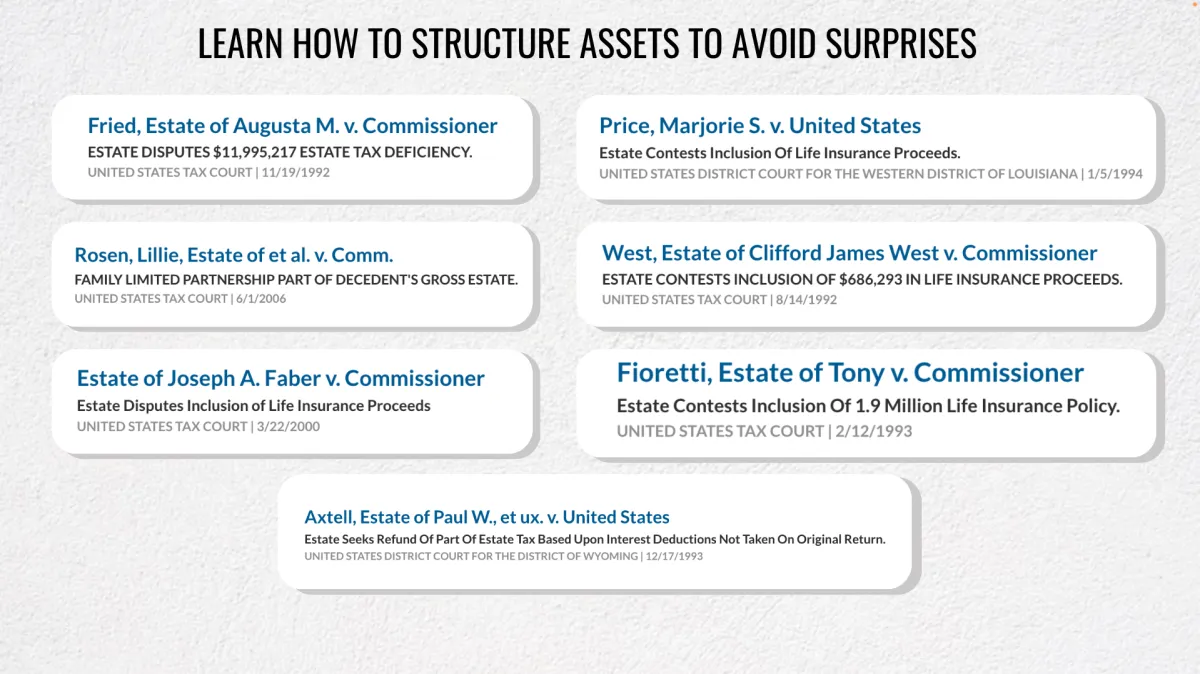

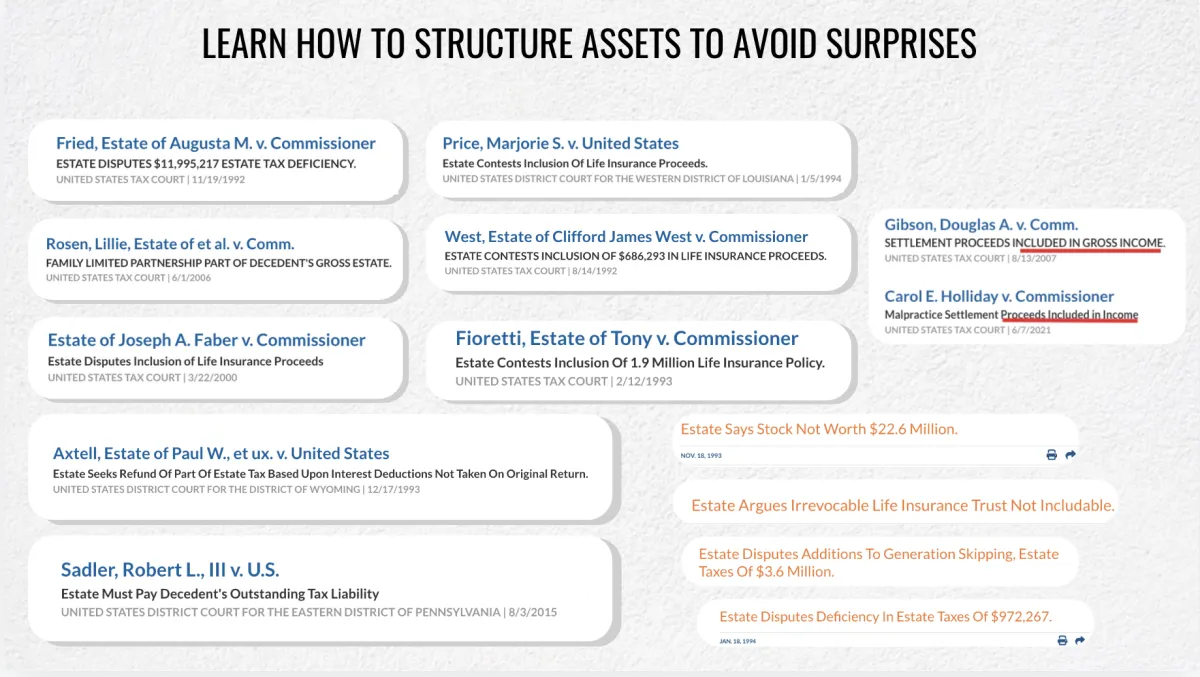

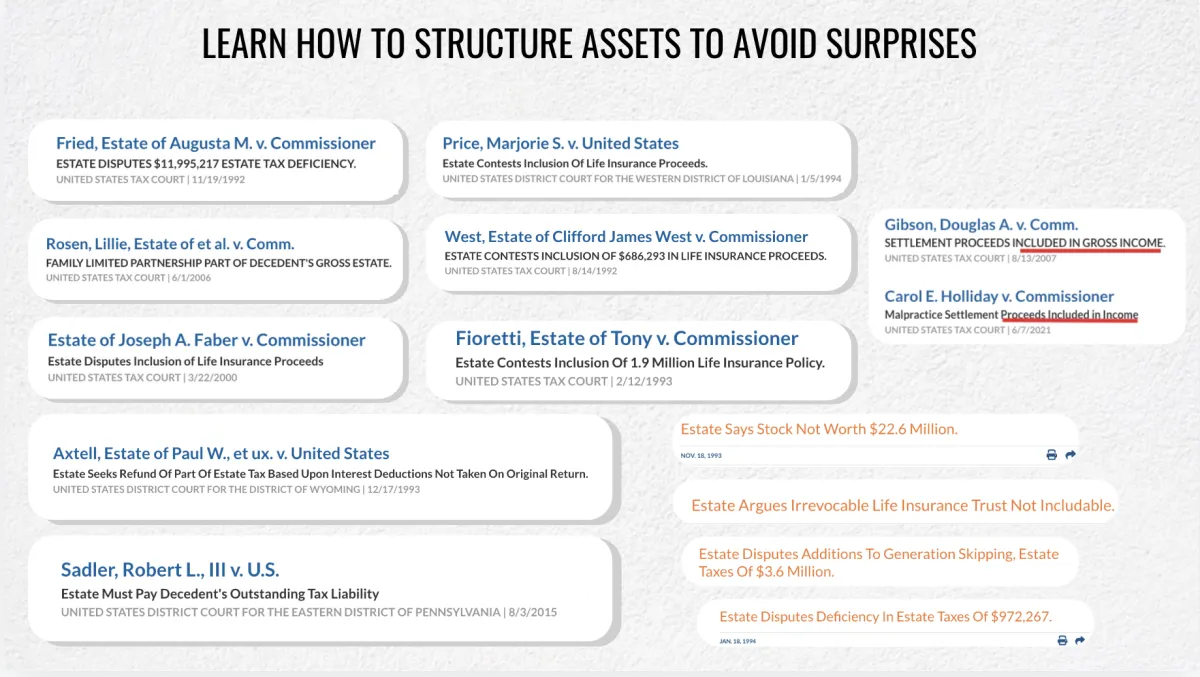

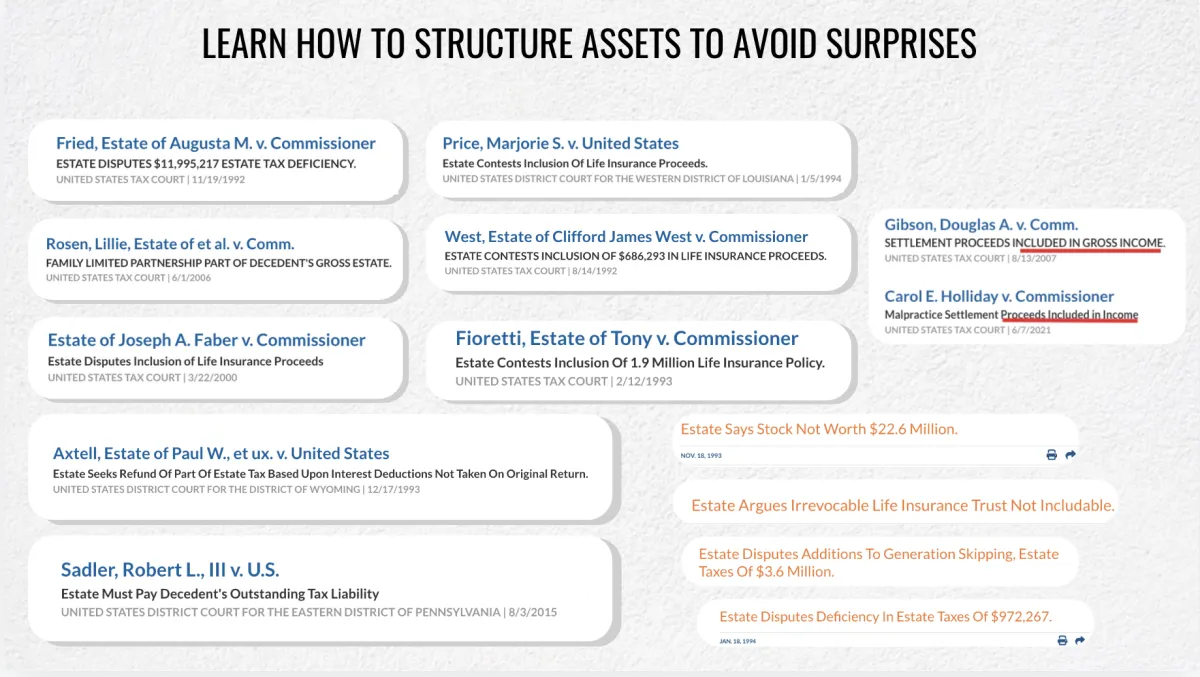

Here are some real-world examples of the consequences clients face due to this gap in coordinated tax and legal strategy that you, the attorney, can bridge and solve for your clients. These are the day-to-day situations your clients end up facing because of this "gap in legal, tax, and financial" strategies:

Bankruptcy Due to Improper Structuring: Without a tax-savvy legal structure, business owners may be personally liable for company debts. Understanding how to purchase, gift, sale, assign, transfer, or manage assets and liabilities can make the difference between winning and losing in a lawsuit.

“Piercing the Corporate Veil”: Clients who rely solely on accountants or financial advisors may not be advised on the importance of formal legal protocols. This leaves their assets exposed if their business is sued, as courts may “pierce the veil” if they determine corporate and personal finances weren’t properly separated. It happened to me and happens to millions.

Hefty Capital Gains Taxes: Selling a business or property can result in unexpected capital gains taxes if no tax strategy was set up in advance. Clients may lose a large portion of their profits because they didn’t establish a trust, private foundation, or other structure to manage and defer taxes - generally ahead of the liquidation event.

Year-End Scramble for Deductions: Without a proactive tax strategy, clients often find themselves scrambling for last-minute deductions at the end of the year. This results in missed opportunities to take advantage of more meaningful, long-term tax-saving strategies.

Purchasing Trusts and Complex Structures Without Knowing How to Use Them: Clients may be advised to buy trusts or form complex structures without understanding their purpose. A lack of guidance means they don’t fully utilize these tools, or worse, they face costly tax or legal issues down the line due to improper management - check out the dirty dozen scams.

Unintended Estate Tax Exposure: Insurance policies and high-value assets are often overlooked in estate planning. When not placed within proper legal entities, these assets may end up being counted in the taxable estate, leading to a substantial estate tax bill that could have been avoided with a coordinated plan.

Overwhelming Estate Tax Obligations: Clients without integrated tax planning often face massive estate tax liabilities upon death. With no coordinated approach among advisors, they miss out on tax-efficient structures like irrevocable trusts, charitable remainder trusts, or private foundations that could reduce or eliminate these taxes.

As the attorney - the interpreter of the law and the chief legal architect for your client - you are in the ideal position to provide holistic legal and tax strategic advisory services. Your unique skill set allows you to bridge the gaps, ensuring every aspect of your client’s legal and financial landscape is coordinated, safeguarded, and optimized.

I've put together the strategies and tools you need to enter this line of work...

Knowledge to Reduce Client Taxes

Knowledge to Reduce Your Own Taxes

Ability to Spot law & Tax Gaps

A Lead-Generating Website

Frameworks and Intake Forms

Practical Problem-Solving With Clients

Process to Monetize Existing Client Lists

By incorporating tax advisory into your practice, you’re tapping into a complementary, non-conflicting, and high-demand area of law that benefits every single client that you've represented and will represent.

Every single client needs tax strategic help, and you are in the most ideal position to provide that service.

Gain Several Immediate Benefits And Advantages By Integrating Tax Law Consulting Services:

Increased Revenue – Capture untapped income by offering high-demand tax advisory services that every client needs - and will likely purchase from others.

Enhanced Client Loyalty – Strengthen relationships with clients by providing comprehensive legal and tax solutions under one roof - become the 'architect' of their legacy.

Competitive Differentiation – Set yourself apart as the legal strategic advisor and lawyer who also educates, empowers, and trains their clients and family members.

Recession-Proof Revenue Stream – Tax planning remains essential in any economic climate, providing consistent and predicable revenue.

The Best Mouse Trap – If you are looking for "lead magnets" and "hooks" to attract and capture more leads, "Death and tax" topics are always top of mind - bring them in for one service, and offer a whole range of other services that you can offer.

Nation-wide Practice – Nonprofit and tax law stem from the tax code - a federal area. Unlock a nationwide practice area that does not need additional bar licenses and qualifications in other states.

Diverse Referral Network – Build relationships with accountants, financial advisors, and other professionals, creating new client channels - all of who refer work to lawyers.

Personal Tax Savings – Solve the exact gaps that you are fixing for your clients. If you're dreams involve million-dollar-law-firms, mansions, sports cars, and a multi-million dollar portfolio - it goes without saying that you need to master this area of law to understand and arm yourself with the right startegies.

Become THE LEGAL WATCHDOG™ for your clients & referral partners – Oversee the big picture for clients, ensuring all financial, legal, and tax elements work in harmony and become the protector and defender of their wealth - the Legal Watchdog™ who ensures everyone's operating ethically and legally - but extremely strategically.

We've Created A Variety of Resources To Help You Learn And Incorporate This Area Of Law Into Your Business and Your Life As Well

You already possess the legal skills, an active law firm, a database of clients and customers, referral sources, and the legal experience to learn and install this area of law into your practice, and we're here to help you through the process, you are NOT alone!

Add Nonprofit & Tax Law Services To Your Firm

Tax Law Training Courses

We've compress decades worth of knowledge into a set of videos and courses

Intake Applications And Forms

Discover how law and tax restructuring can be offered to your clients

Implementation and Delivery Services

Gain access to extremely nuanced research covering business, estate, nonprofit & tax topics

Join Our Mission & Partner With Us

Offer Pro Bono Sessions

Discover a "secret" high-ticket ecommerce strategy that very few people have tapped into - which has proven to produce over 40x return.

Leverage These Strategies

In this uniquely crafted course, you'll discover the exact steps that you can deploy to secure a lifetime of grants from Fortune 500 companies.

Joint Ventures & Affiliate Program

Discover the secrets to turning your knowledge and skills into a digital course that can be sold on the internet 24/7 - without any tech overwhelm.

Startegies We Offer To Lawyers & Clients

Public Nonprofits

Discover a "secret" high-ticket ecommerce strategy that very few people have tapped into - which has proven to produce over 40x return.

Private Foundations

In this uniquely crafted course, you'll discover the exact steps that you can deploy to secure a lifetime of grants from Fortune 500 companies.

Mini Family Office™

Discover the secrets to turning your knowledge and skills into a digital course that can be sold on the internet 24/7 - without any tech overwhelm.

Tell Us About Your Current Law Firm

Schedule A Call To Chat With Sid

BecomeATaxLawyer.com™ | No Legal, Tax, or Financial Advice Contained Or Given | No Attorney-Client Relationship Formed

© Copyrighted Material - All Rights Reserved 2023